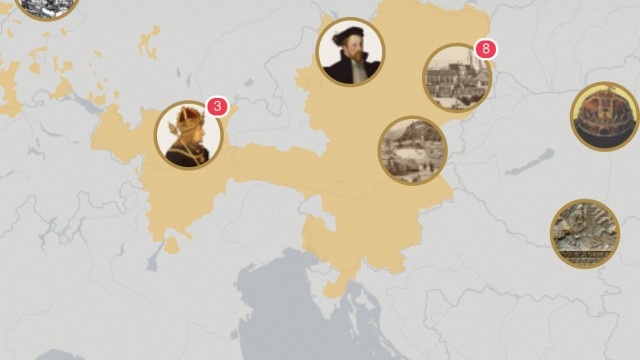

Survey the country and put a tax on land – The Josephinian land register was used for a new system of taxation

On Joseph II’s orders all the land in the monarchy was surveyed and classified. However, the new tax system did not last for very long.

Even under Maria Theresia the tax exemption granted to the upper classes had been restricted, which meant that both the aristocracy and the Church had to pay taxes. The basis for assessment was the Theresian Taxation Schedule, which was applied in very different ways in the various Crown lands. In contrast Joseph II wanted to have a unified system of taxation in all parts of the Monarchy. The amount of tax to be paid was to be calculated on the basis of the gross yield of the plot of land (for example the income from the harvest, cattle breeding, forestry or ponds). To do this all land had to be surveyed and classified. The resulting land register, known as the Josephinischer Kataster, was the first standardized record of all land in the Monarchy. Local magistrates and jurymen were responsible for the survey and were supervized by officers specially appointed for the task. Land owners, who were supposed to be present during the procedure, had to submit tax returns to enable the revenue from their property to be calculated.. As a result landowners felt that their rights had been curtailed and that they had been deprived of power, because they were no longer the ones who collected taxes from the population: this was now done by the local government offices directly responsible to the monarch.

When Leopold II came to the throne the opponents of the Josephinian land register found him sympathetic to their cause: in 1790 he abolished his predecessor’s regulations regarding taxation and agricultural land, much to the joy of aristocratic and ecclesiastical land owners – Joseph II’s system had thus been in effect for just some six months. The present-day Austrian land taxation register is based on the register compiled under Franz I in 1817.