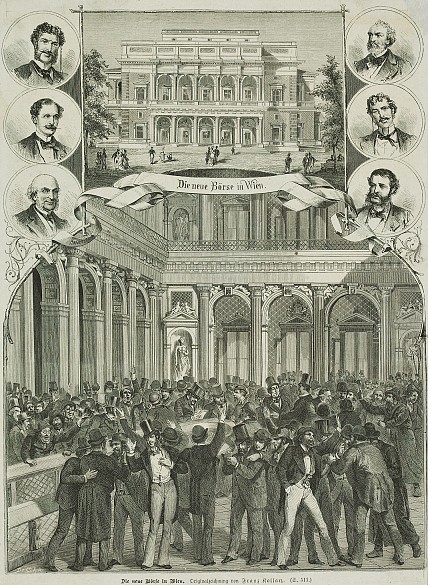

Let speculation commence ... The founding of the Vienna Stock Exchange

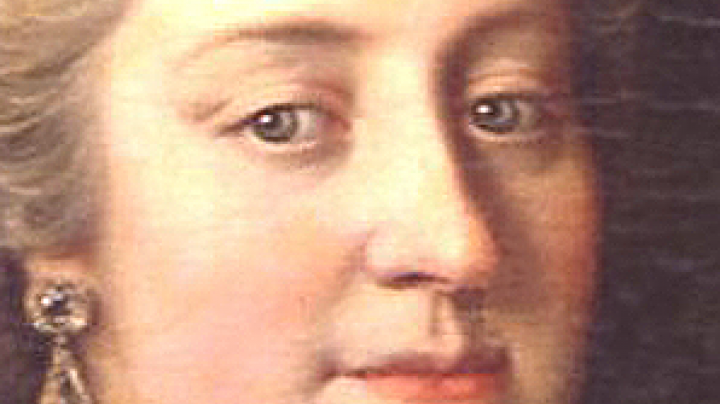

‘Let speculation begin,’ Maria Theresa may well have thought when she issued the founding charter of the Vienna Stock Exchange in 1771. This also created a new profession – that of stockbroker.

Quote from the Stock Exchange’s founding charter of 1771 regarding its hours of businessThe stock exchange shall be open on all days with the exception of Sundays and prescribed holidays from 11 a.m. to 1 p.m., and between Michaelmas [29 September] and St George’s Day [23 April] from 3 p.m. to 4 p.m., and between St George’s Day and Michaelmas from 3 p.m. to 5 p.m.

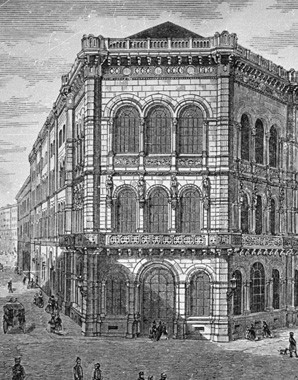

The stock exchange was intended on the one hand to raise money for the state, whose finances were always in poor shape, by means of government bonds. On the other hand it was meant to stem unregulated dealing in these bonds and in the paper money which had been issued since 1762. It was feared that unauthorized brokers would buy bonds and notes at very low prices and thus reduce the income the state received from the such loans. It was also intended that prospective buyers should no longer acquire their notes from the institution responsible for the fund, for example the Vienna City Bank (Wiener Stadtbank), but do so on the stock exchange for the highest possible price. The Vienna Stock Exchange was put in the charge of a stock exchange commissioner, who had a military guard at his disposal – in case there were disturbances. The actual business of the exchange was done by brokers, with the rules stipulating that under no circumstances should they be bankrupt traders or under twenty-five years of age.

It was, though, only a relatively small group who were admitted to the stock exchange, even if all the estates were permitted: those who had to remain outside included ‘idiots’, bankrupts, convicted criminals – and women.

In contrast to other stock exchanges in Europe, the Vienna exchange was allowed to deal only in government bonds and currencies and not in commodities. The first shares (for a bank) were issued in 1816 and then again in 1842 (for the Emperor Ferdinand Northern Railway). From the middle of the nineteenth century the exchange played a key role in raising the capital for new industrial enterprises. A branch-like system of exchanges was therefore set up throughout the Habsburg territories, whose rates were all based on those of the stock exchange in Vienna.